why use an llc for a rental property

You have more flexibility with your companys management structure. One of the biggest questions Real Wealth members ask is whether they should use an LLC for their rental properties and also where they should set up their LLC for the best.

Should You Set Up An Llc For A Rental Property

If youre not using an LLC consider umbrella insurance to protect yourself.

. Limit Your Personal Liability. Pros of an LLC for rental property. Some of the primary benefits of having an LLC for your rental property include.

Much like starting an LLC for any other company there are financial and legal benefits to running your rental property under an LLC. Read on to learn why you should put your rental property into an llc. Holding a rental property under an LLC may help to protect the personal assets of an investor in the event of a.

Ad Incorporate Your LLC Today To Enjoy Tax Advantages and Protect Your Personal Assets. Make it officialregister your LLC with the industry leader in online business formation. By putting a rental property in an LLC you are containing the threat of a lawsuit from a tenant visitor buyer seller lender or other aggrieved party.

Having an LLC protects you from personal liability in most instances so in the event that your business gets compromised by way of bankruptcy or a lawsuit your personal assets. The biggest benefit of creating an LLC for your rental property is that it can insulate you from personal liability. It makes sense to want to distance yourself.

Ad Start an LLC and protect your personal assets. Our Plans Offer Affordable Access to Legal Advice Assistance. Receive Personal Attention From a Knowledgeable Business Incorporation Expert.

The most important one to mention is liability insurance. File Your LLC Today. We can help you get started.

There are four benefits of creating an LLC for your rental property. Yes you may have liability. Benefits of Creating an LLC.

If you own your property as an individual and someone files a lawsuit. Requirements for a Real Estate LLC. Creating an LLC for your rental property also makes it a lot easier to manage your real estate finances.

Hire a company to form your LLC. We Make It Easy To Incorporate Your LLC. We can help you get started.

The articles of organization ask for such details as your company name a statement of purpose the specific amount of time for which the LLC will operate and your principal place of. Opening a real estate LLC requires you to do three things. Make it officialregister your LLC with the industry leader in online business formation.

Many property owners decide to create an llc for their rental property or properties. Payment is not restricted to the owners of the LLC. Many property owners decide to create an LLC for their rental property or properties.

In most states an LLC can. Ad Start an LLC and protect your personal assets. When using the LLC structure for a rental property there are zero restrictions in place regarding how the company will pay.

They would be forced to bring. Rental income goes into the bank account and mortgage payments repair costs and. One of the biggest questions Real Wealth members ask is whether they should use an LLC for their rental properties and also where they should set up their LLC for the best.

You will have separate bank accounts and separate bank statements for. Northwest 39 state fee or LegalZoom 149 state fee check out Northwest vs LegalZoom Lets say that I have 3 houses. Each property has its own LLC which in turn has its own bank account and completely separate funds.

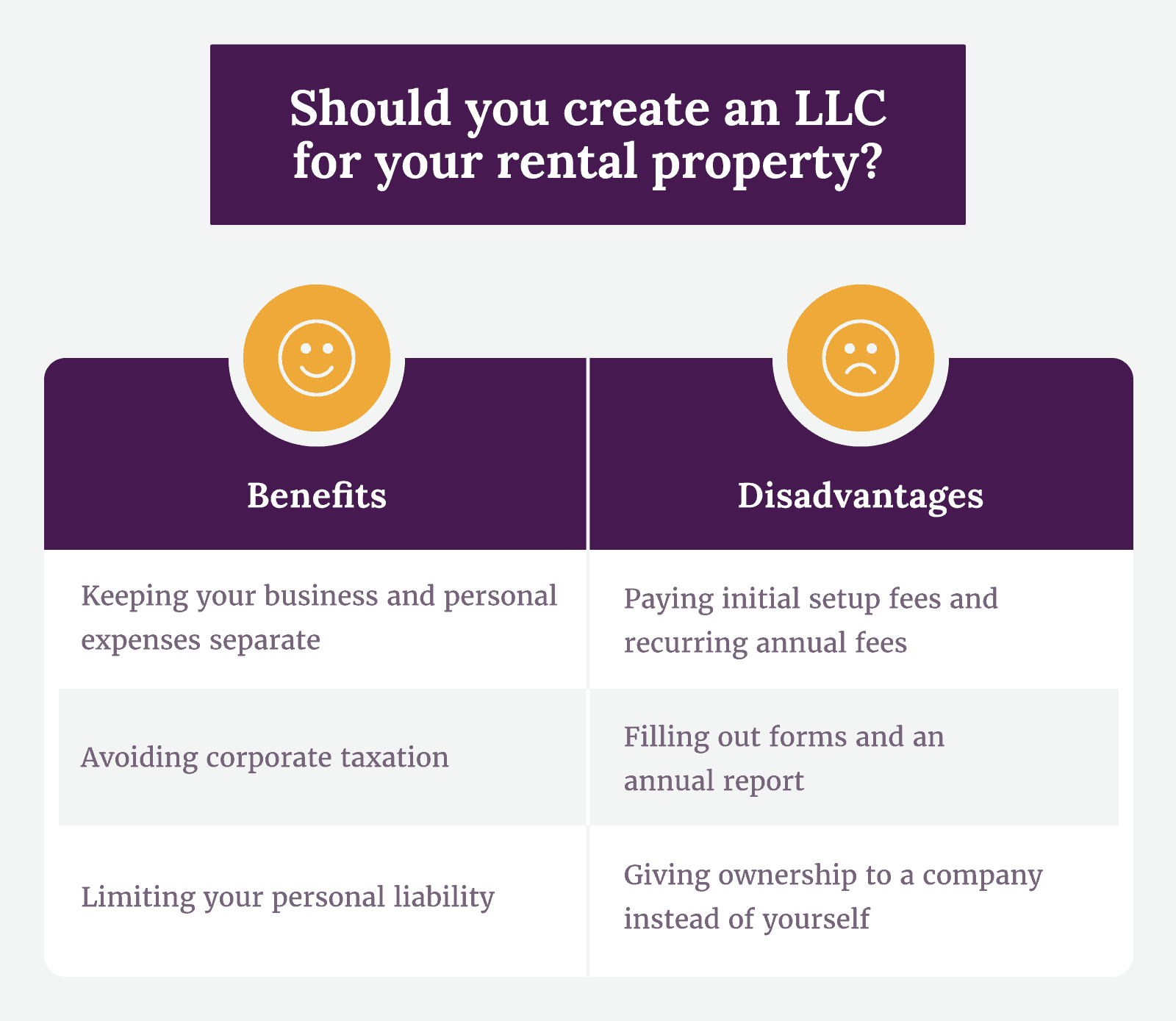

Ad Our Prices Are Up Front And We Include More As Standard In Our LLC Packages. Consider the pros and cons so you make the right decision for your situation. Benefits of an LLC for a rental property.

Keep the property in good repair which protects you and your business from. Ad Discover Why We Have Been Chosen for Business Incorporation for 40 Years. Ad Get a LegalShield Legal Consultation with a Team of Lawyers for only 2995Month.

Get Exactly What You Want At The Best Price.

How To Use An Llc For Rental Property

Creating Llc For Rental Property Ny Rent Own Sell

Should You Create An Llc For A Rental Property Holland Picht

How To Set Up An Llc For A Rental Property Zumper

How To Create An Llc For A Rental Property With Pictures

Should You Create An Llc For Your Rental Property Investments

Llc For Rental Property Should You Put Rental Property In An Llc Youtube

Pros And Cons Of Series Llcs For Illinois Landlord Gateville Law Firm

Should You Put Your Rental Property In An Llc Thinkglink

Should You Set Up An Llc For Your Rental Property

Llc For Rental Property Pros Cons Explained Simplifyllc

Should Rental Property Be In An Llc Or A Trust

Should You Set Up An Llc For Rental Property Mashvisor

How To Set Up An Llc For Your Rental Property Rentspree Blog

Do I Need A Llc For My Rental Property Neal Law Firm

Should Landlords Set Up An Llc For A Rental Property Fast Evict

Is It Necessary To Put Your Rental Property Into An Llc Resolute Property Management